The Market Bottom

A Once-in-a-Decade Opportunity for Early Stage Investing

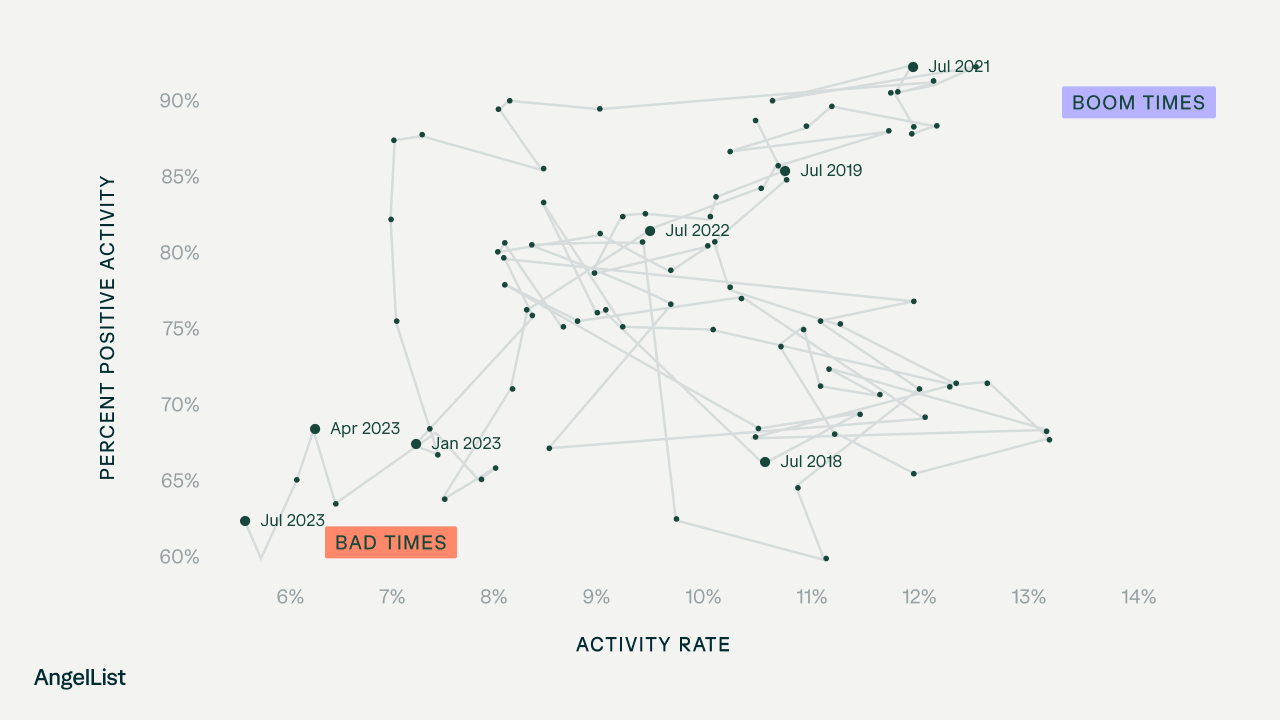

The startup and early-stage venture ecosystem continues to navigate challenging waters in 2022 and into 2023. However, beneath the surface of gloomy headlines and declining deal activity, this period may present unique opportunities for savvy investors willing to take a patient, long-term view. According to the latest quarterly report on the state of U.…